Canada and Mexico often trade places as the largest trading partners of the U.S. Many U.S. firms with cross-border supply chains trade extensively with both countries. The U.S. Census Bureau’s Profile of U.S. Importing and Exporting Companies provides interesting firm-level insight.

In 2023, more than 94,000 firms exported to Canada, making it the largest single market. By comparison, about 96,500 firms exported to all of Europe. Mexico ranked second with nearly 55,000 exporting firms, while China, in third place, had only 29,500. While geography plays a role, these differences also reflect the structure of supply chains within the CUSMA region.

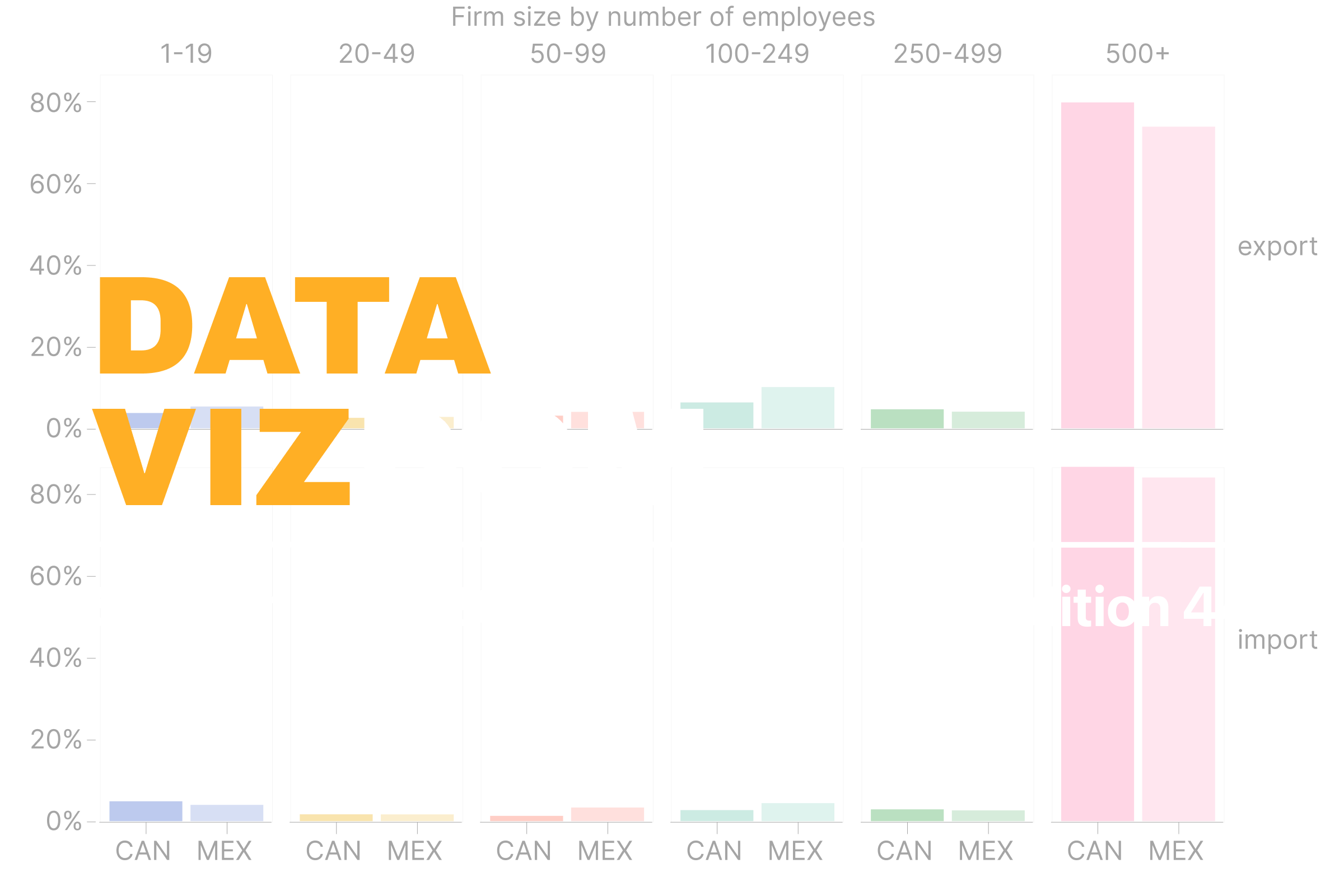

The chart below shows the distribution of firms by employee size that have either exported or imported with Canada and Mexico. More U.S. firms of every size have Canada as an export market than Mexico, with one exception. The smallest firms importing from Mexico slightly outnumber those importing from Canada.

When it comes to imports, however, the picture shifts. China is by far the largest sourcing market with over 121,000 identified U.S. importing firms, well ahead of Canada’s 25,000 and Mexico’s 21,000. This underscores that Canada and Mexico matter not just as suppliers but also important export markets.

Looking beyond the number of firms, the second chart below highlights the value of trade these firms account for. In 2023, U.S. exports to Canada reached $354 billion and to Mexico $322 billion, while imports were $418 billion from Canada and $475 billion from Mexico. Larger firms dominate this trade, but the pattern differs across partners. Smaller U.S. firms contribute a relatively larger share of trade with Mexico than they do with Canada.

Finally, the third chart below shifts the focus to intensity by showing average trade per firm by size. Here, Mexico stands out. For every firm size, U.S. companies trade more on average with Mexico than with Canada, with the gap especially large among the biggest firms importing from Mexico.

To conclude, while large firms dominate U.S. trade with Canada and Mexico in value terms, tens of thousands of small and medium-sized firms also actively trade. Given that SMEs overall represent about 44% of U.S. GDP and employ half the workforce, their role in sustaining trade within the CUSMA region underscores the importance of preserving tariff-free access for firms of all sizes.

Data Vizdom digs into ideas big and small through visualizations that help make sense of a changing world, drawing on data from the SLGL dataHub.