The intermodal interface between rail and ports is a critical component of Canada’s transport infrastructure. While this intermodality enables the efficient movement of bulk commodities from the place of production to domestic and international markets across Canada’s vast geography, it also plays a key role in containerized freight transport.

Supply chains that rely on this intermodal system require fluidity, and performance is typically assessed using metrics such as end-to-end transit times—for example, the time it takes for a container to travel from Shanghai to Toronto. While such metrics provide insight into the overall system’s performance, they can obscure delays originating in specific segments of the supply chain.

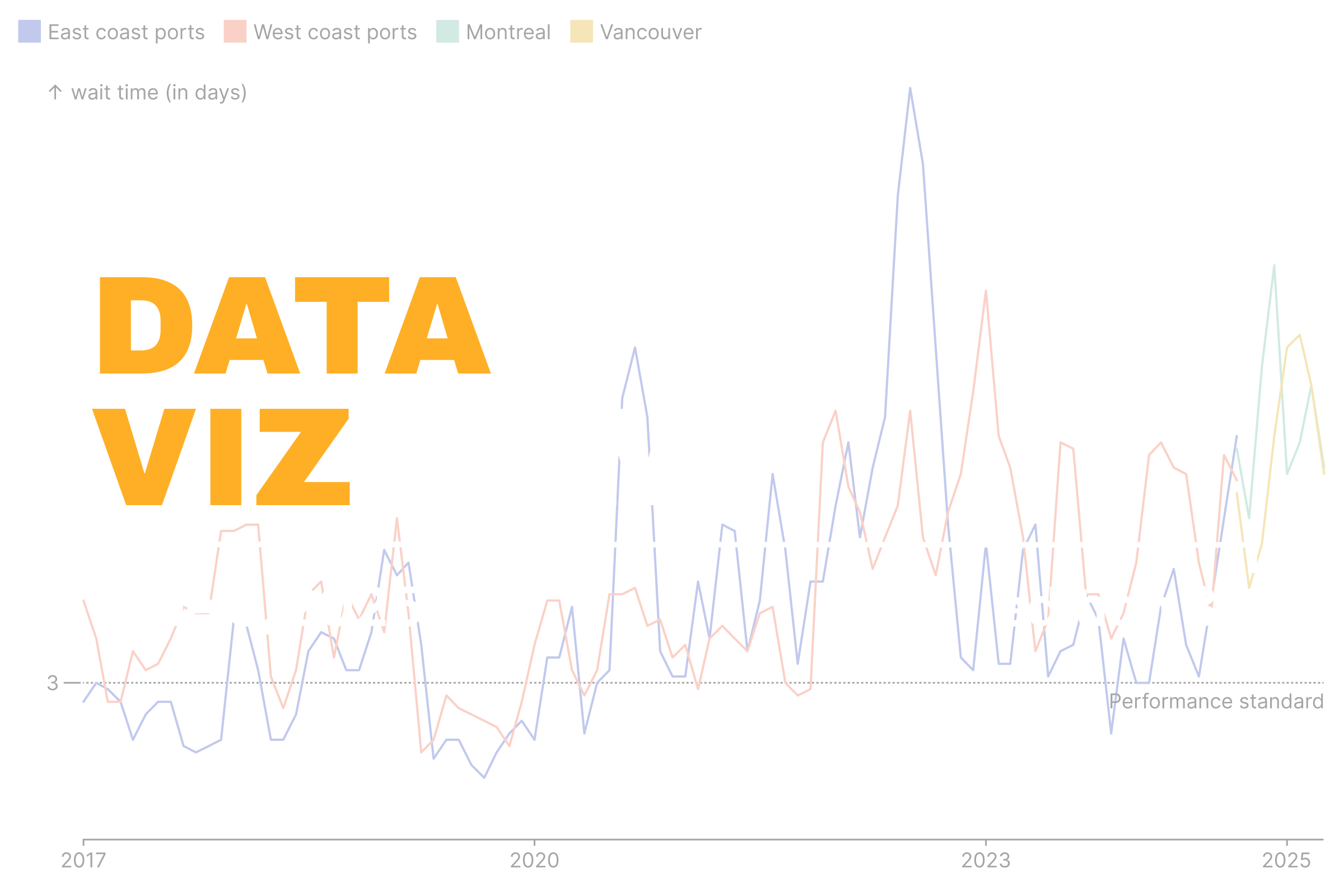

To isolate bottlenecks at port terminals, Transport Canada publishes monthly port dwell times for eastern (Montreal and Halifax) and western (Vancouver and Prince Rupert) ports. This indicator measures the average time an imported container spends at the port—specifically, from the moment it is unloaded from a vessel to when it is loaded onto a train or truck. It provides insight into terminal-level performance and delays at the modal interface.

Since the most recent observation for this indicator ends in September 2024, we supplement the analysis with more recent data from the ports of Montreal and Vancouver. As these two ports handle the majority of Canada’s seaborne container traffic, their dwell time patterns closely reflect prior trends across both coasts, offering a reliable continuation of the dataset.

Both the Port of Montreal and the Port of Vancouver have a set performance standard of three days for container transfers at their terminals.

However, average turnaround times at eastern ports have seen major spikes since the pandemic, peaking at over eight days in September 2020 and more than twelve days in July 2022. Since June 2024, wait times have been rising again and now exceed six days at the Port of Montreal—twice the performance standard.

At the western ports, wait times surged to nearly seven days in December 2021 and reached over nine days in January 2023. As of April 2025, dwell times at the Port of Vancouver remain elevated at over six days, well above pre-pandemic levels.

Surges in vessel traffic can lead to congestion, as more containers require additional or longer trains to maintain transfer rates. However, labour disruptions and weather conditions also contribute to delays. Strikes at ports or severe winter weather can force rail operators to run shorter trains, both of which reduce the efficiency of container turnaround.

Persistent dwell time delays highlight the need for targeted investment in intermodal infrastructure and operational resilience. Improving port-rail coordination and mitigating disruption risks will be critical to maintaining supply chain fluidity and supporting Canada’s trade competitiveness.

What better way to understand concepts big and small than through data visualizations? In this blog series, we explore timely themes in economics and transportation, drawing on data from the SLGL dataHub.