What better way to understand concepts big and small than through data visualizations? In this blog series, we produce insightful visuals using data from the SLGL dataHub to provide commentary on themes related to economics and transportation. Follow us as we explore and engage with interesting ideas.

Over the past week, escalations between the U.S. and China extended beyond broad tariffs. China has imposed export control measures on six minerals that fall within the umbrella of 17 rare-earth elements, requiring exporters to obtain special licenses and submit additional paperwork. This lever of control was recently exercised in February to restrict exports of five minerals, four of which are considered critical by the U.S. Department of Energy.

Rare earths are metallic elements essential for lasers, magnets, and semiconductors used in everything from smartphones and EV motors to wind turbines, radar systems, and fighter jets. Though needed only in small quantities, their role in strategic technologies makes concentrated supply a serious risk. Out of the 17 rare-earth elements, 16 are classified as critical by the U.S.

Despite the name, many are relatively abundant but often dispersed, found in low concentrations, or occur alongside radioactive minerals. China leads in refining, having developed the technically complex and costly methods needed to separate them from ore, while also bearing the heavy environmental toll of toxic chemical use.

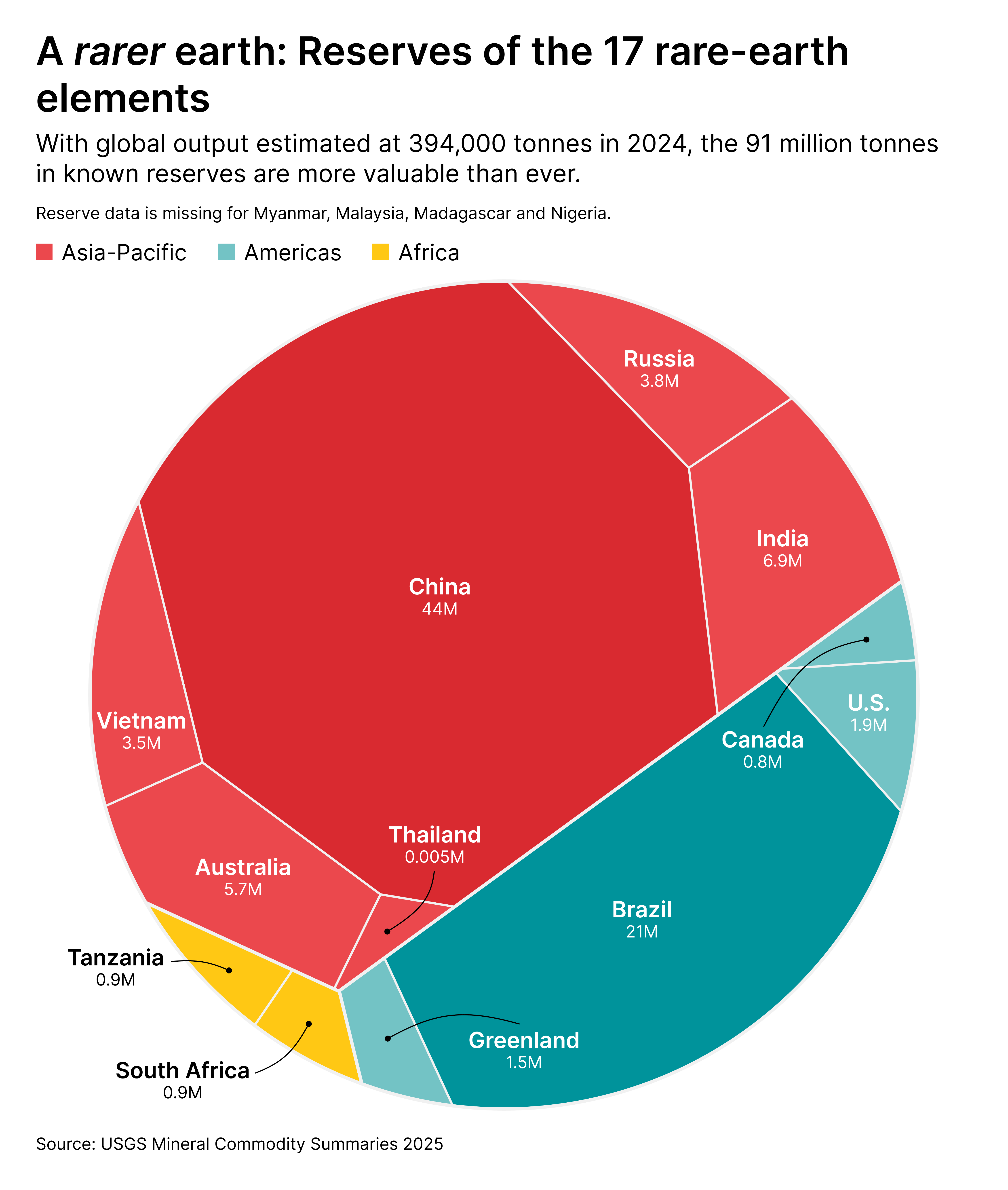

The chart below shows the distribution of known reserves in countries that have extensively mapped their deposits. Note that Myanmar, Malaysia, Madagascar, Nigeria, and a few undisclosed countries contributed to the estimated 394,000 tonnes of global output in 2024, though reserve data for them is unavailable.

Known reserves of rare earths are estimated at nearly 91 million tonnes. About 70 percent of these are located in the Asia-Pacific region, with China alone accounting for 48 percent of the global total. The Americas hold 28 percent, and the remainder is found in Africa. In terms of production, China made up 69 percent of global output in 2024, which stood at 394,000 tonnes. The U.S. and Myanmar followed, contributing 11 percent and 8 percent respectively.

As demand for clean energy, advanced electronics, and defence technologies continues to grow, the importance of rare earths in global supply chains is rising. With China playing a central role in refining and holding a significant share of reserves, its position is likely to remain influential. As global trade dynamics continue to evolve, more countries will look to diversify supply, invest in processing capacity, and strengthen access to these critical materials.

Help us make this series even better! We would love to hear your thoughts and suggestions on content ideas and other noteworthy visualizations. Write to Bilal Siddika on LinkedIn or via email.