What better way to understand concepts big and small than through data visualizations? In this blog series, we produce insightful visuals using data from the SLGL dataHub to provide commentary on themes related to economics and transportation. Follow us as we explore and engage with interesting ideas.

The past few years have seen tumultuous twists and turns in Canada–China relations. Canada’s imposition of tariffs on Chinese EVs, steel, and aluminum in October 2024 further escalated tensions. These measures were part of a broader Western response to China’s use of subsidies and regulatory gaps to artificially lower production costs in these sectors. With abundant access to critical minerals, Canada is well positioned for mining, refining, and battery production for EVs. As large-scale investments are being made to build capacity across the EV battery supply chain, such protectionist measures are seen as necessary to shield domestic firms from downward pricing pressures.

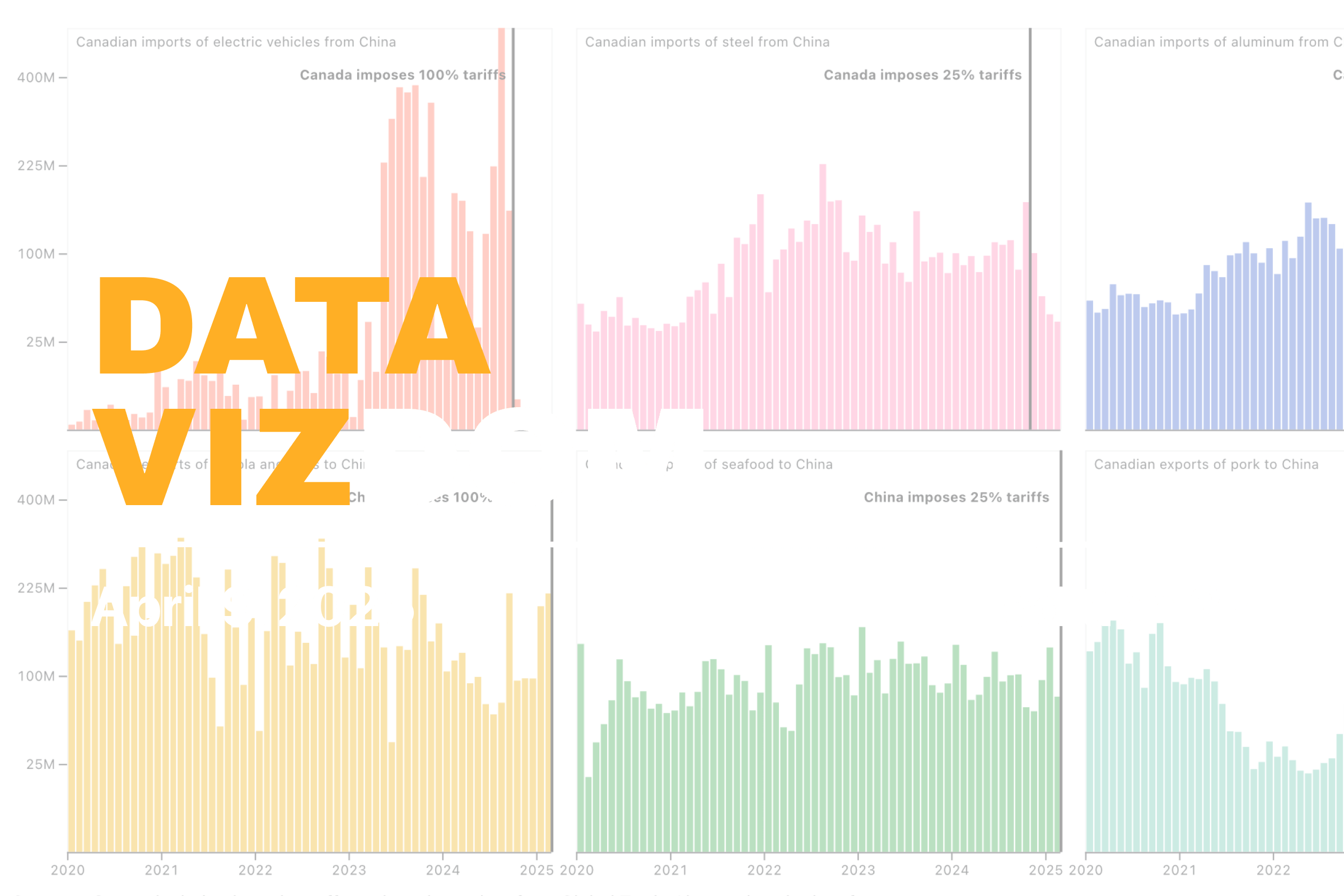

Starting October 2024, Canada imposed a 100% surtax on top of the existing MFN rate of 6.1% charged on Chinese EVs. A 25% tariff was also applied to steel and aluminum imports from China. In response, China launched what it calls a domestic anti-discrimination probe into Canadian canola and lodged a complaint with the WTO. As of 20 March 2025, China imposes a 100% tariff on Canadian canola and peas, along with 25% tariffs on seafood and pork. China has previously targeted Canada’s agriculture sector, including restrictions on canola seed imports that lasted nearly three years. The visualization below shows monthly imports of Chinese EVs, steel, and aluminum, as well as exports of canola and peas, seafood, and pork to China from January 2020 to February 2025.

Imports of EVs from China surged in 2023 to nearly $2.3 billion, up from $116 million in 2022. The increase was largely driven by higher-end models, likely Teslas manufactured in China, as the average unit cost rose from $11,660 to $51,300. Fearing a flood of low-cost Chinese EVs that North American firms could not match on price or technology, the Canadian government imposed steep tariffs. As a result, imports of Chinese EVs have nearly ceased. A similar trend is seen in steel and aluminum, with monthly import values falling from $80 to $120 million to $20 to $40 million by February 2025. The Canadian tariffs target about $4 billion worth of Chinese imports based on 2024 values, while China’s retaliation affects roughly $2.9 billion in Canadian exports.

China relies almost entirely on Canada for its canola imports, with Canada being one of the world’s largest producers. In 2024, China imported 2.5 million metric tonnes of canola and peas worth $1.2 billion from Canada, down from nearly $2 billion in 2023. The newly imposed 100% tariff is expected to further reduce exports in 2025, which currently stand at $409 million. Seafood exports to China totaled $1.1 billion in 2024, down from $1.3 billion the previous year, with the first two months of 2025 accounting for $212 million. Pork exports, already lower than early 2020s levels, reached $467 million in 2024. The 25% tariff on seafood is likely to disproportionately affect Atlantic provinces which rely heavily on these exports.

With protectionist measures becoming more common, the distinction between industrial policy and trade responses is increasingly complex. Canada’s tariffs are intended to support its domestic EV industry, while China’s actions reflect the challenges that can arise from mutual trade dependencies. These developments are part of a broader trend, seen since the late 2010s, where major economies have adopted more assertive trade policies in the interest of national competitiveness. Canada’s dispute with China illustrates how countries are balancing openness with economic resilience, and how trade decisions are now influenced by both economic and strategic considerations.

Help us make this series even better! We would love to hear your thoughts and suggestions on content ideas and other noteworthy visualizations. Write to Bilal Siddika on LinkedIn or via email.