What better way to understand concepts big and small than through data visualizations? In this blog series, we produce insightful visuals using data from the SLGL dataHub to provide commentary on themes related to economics and transportation. Follow us as we explore and engage with interesting ideas.

With Lucien Chaffa

With the U.S. administration expected to announce a slew of new tariffs against its largest trading partners on April 2, trade disruptions are inevitable. Setting aside the likely reciprocal measures against the U.S., the impact of these tariffs will depend on their geographical scope, creating opportunities for firms to adjust their strategies. If tariffs become a long-term fixture, trade and production patterns are bound to shift.

The EU, one of the world’s largest single markets, could present new opportunities for Canadian firms if American goods face retaliatory tariffs. In this scenario, certain Canadian exports may gain a competitive edge over their U.S. counterparts, leading to increased trade with the EU. Some portion of the U.S. market share in the EU could be up for grabs.

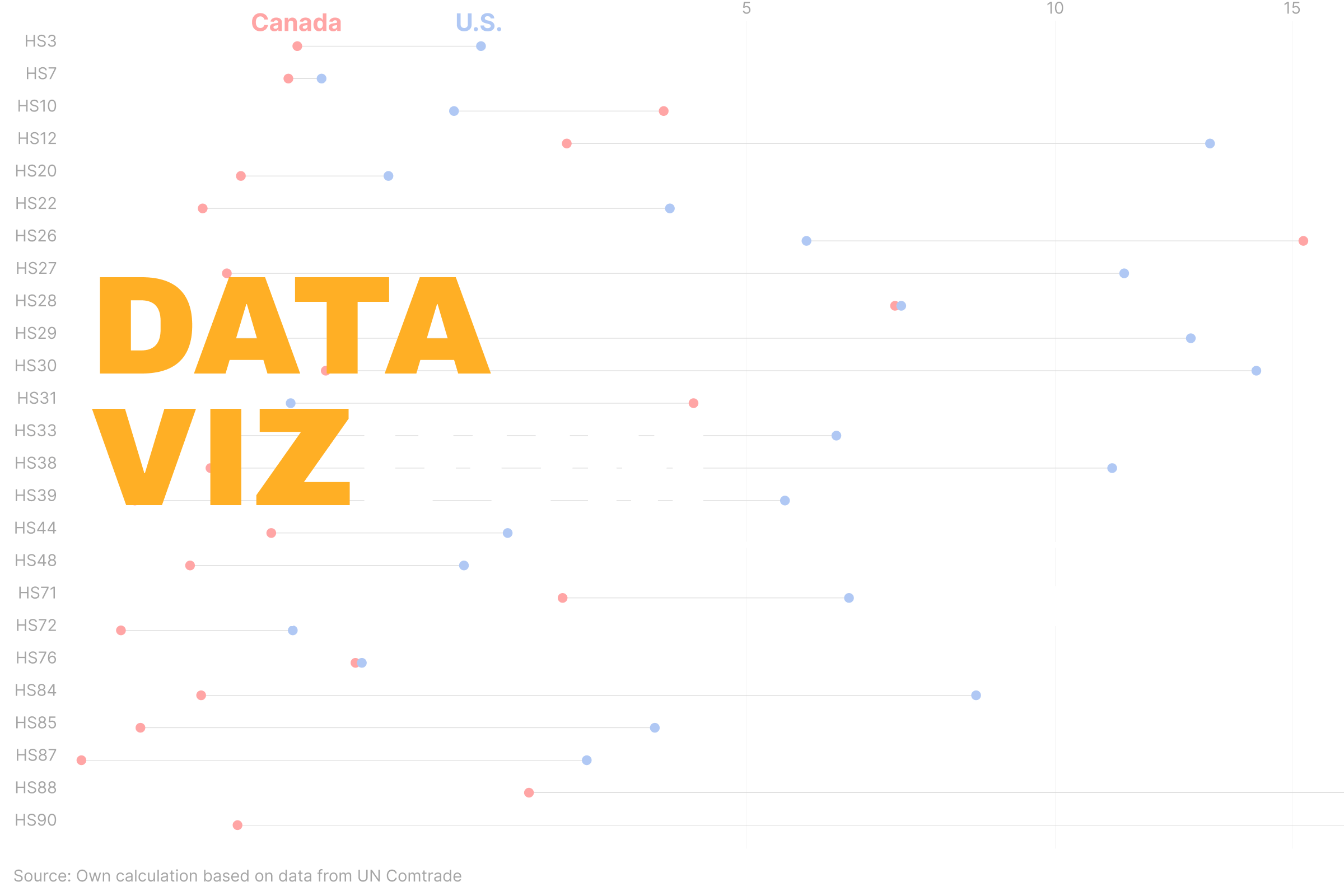

The visualization below highlights the market share of Canada and the U.S. for the top 25 Canadian exports to the EU by value. Hover over the dots to explore the sectors that likely offer the easiest opportunities for expansion.

Commodities where both Canada’s and the U.S.’s market share is below 5% are unlikely to see significant shifts in Canada’s favor, as firms may seek alternatives closer to home. In contrast, sectors where Canada already holds a larger share present greater opportunities for market expansion. However, geographical and commodity-level aggregation may introduce biases. At more granular levels of disaggregation, the market share for both Canada and the U.S. would likely appear higher, offering a more detailed and accurate picture.

Canada stands to gain from shifting trade dynamics, but the extent of its advantage will depend on sector-specific competitiveness and firms’ ability to adapt. While some exports may benefit from U.S. tariffs, long-term success requires strategic positioning and a nuanced understanding of market opportunities in the EU.

Help us make this series even better! We would love to hear your thoughts and suggestions on content ideas and other noteworthy visualizations. Write to Bilal Siddika on LinkedIn or via email.