What better way to understand concepts big and small than through data visualizations? In this blog series, we curate insightful visuals to provide commentary on events, academic theories and themes related to economics and transportation. Join us as we explore and engage with interesting ideas from around the world.

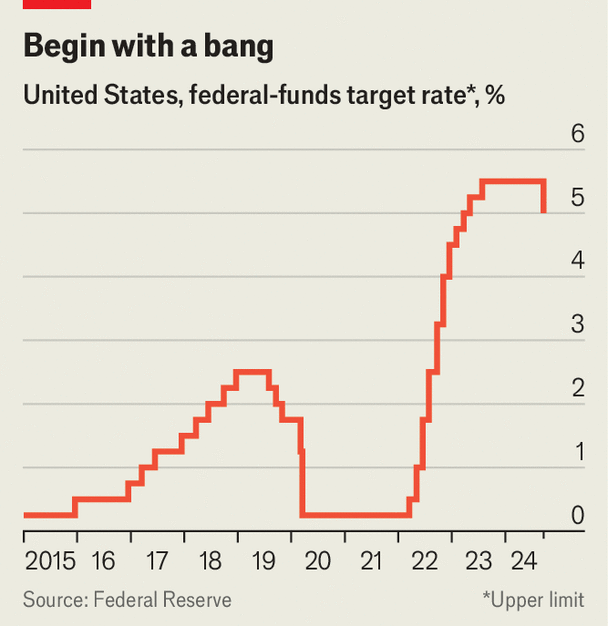

This past Wednesday, the US Federal Reserve cut its benchmark interest rate by 50 basis points, marking the first reduction since March 2020. After a period of monetary tightening aimed at keeping inflation in check and tempering a hot economy, the rate cut arrives to stimulate a cooling labour market. This week’s Data Vizdom peruses the fascinating dynamics of interest rates and their far-reaching effects on the global economy.

Why the Federal Reserve has gambled on a big interest-rate cut – The Economist (September 18, 2024)

Interest rates are a mainstay of central banks’ monetary policy, as they directly influence the level of activity in an economy. At its simplest, a rate change adjusts the cost of borrowing for businesses and individuals, impacting investment and consumption patterns. Given its wide-reaching effects on the economy, stock market investors closely monitor interest rate movements.

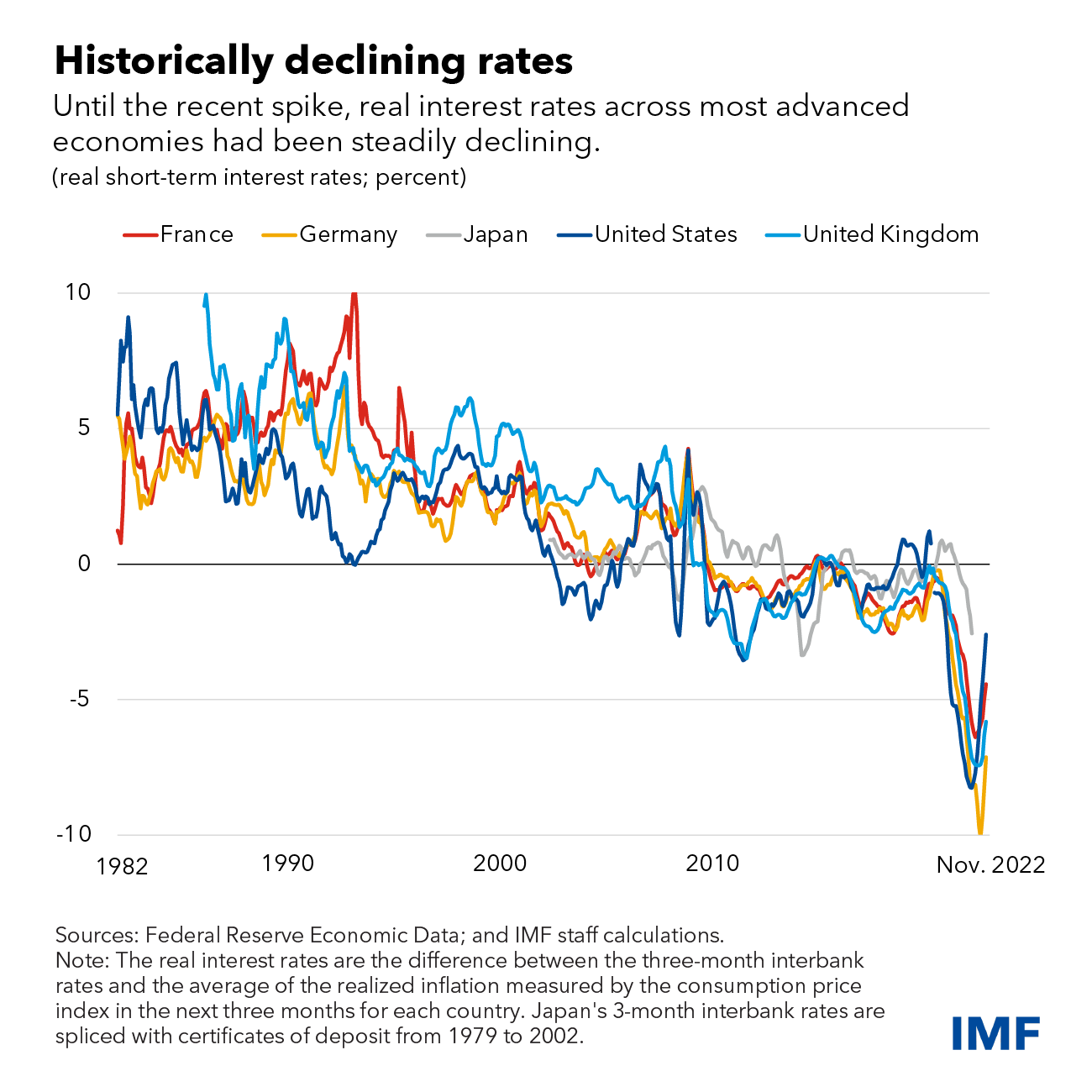

Central banks strategically adjust interest rates to manage sustainable economic growth while controlling factors such as inflation. While their approaches differ to account for domestic economic realities, the visualization below shows that real interest rates (interest rates adjusted for inflation) in major Western economies have followed similar trends over the past 4 decades.

Interest Rates Likely to Return Toward Pre-Pandemic Levels When Inflation is Tamed – IMF (April 10, 2023)

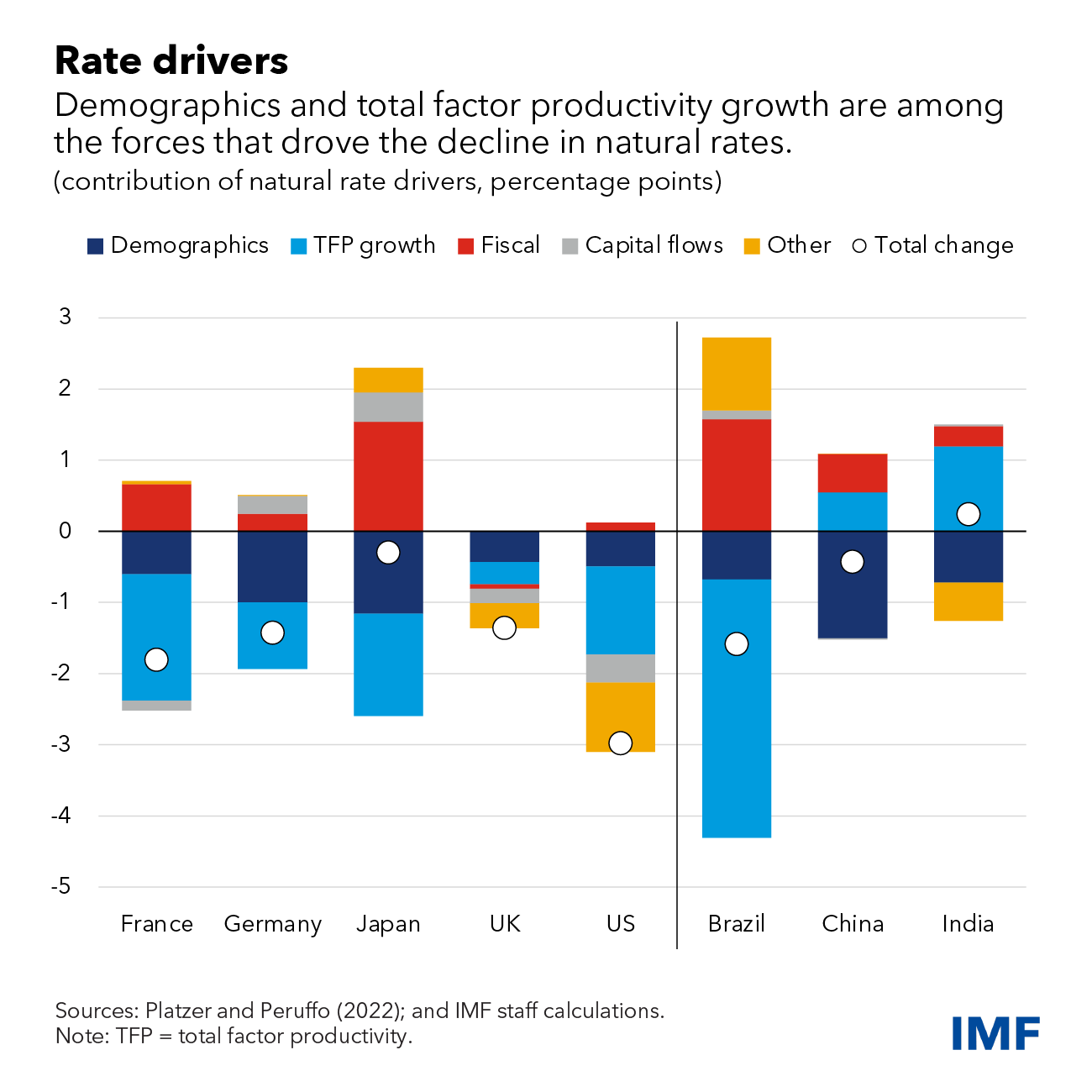

The IMF conducted an in-depth analysis to assess the extent to which global and domestic factors contribute to interest rate synchronization. They found that the net effect of global forces on interest rates has been relatively modest. Instead, growth in total factor productivity and demographic changes have primarily driven the historical decline in interest rates. This trend differs somewhat in emerging economies like India, as shown below.

Interest Rates Likely to Return Toward Pre-Pandemic Levels When Inflation is Tamed – IMF (April 10, 2023)

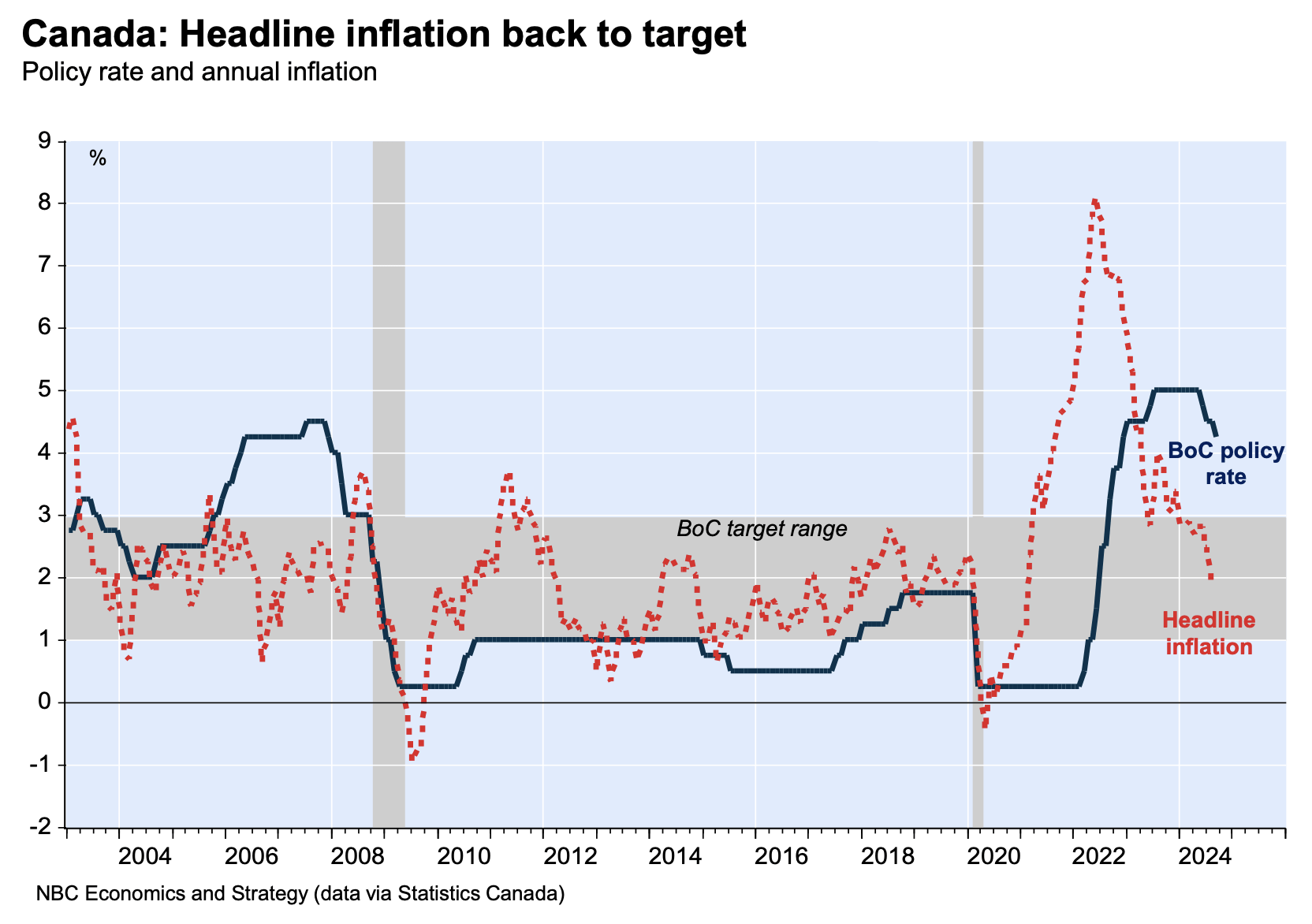

Economists at the National Bank of Canada argue that the Bank of Canada should adopt more aggressive rate cuts, as inflation—excluding mortgage interest costs and rent prices—has come under control. To achieve further meaningful reductions, the cost of borrowing for homeowners must decrease. They also contend that the labor market is in dire need of a boost, as the country’s unemployment rate is on the rise.

Canada: CPI inflation declines faster than BoC rate cuts – National Bank of Canada (September 17, 2024)

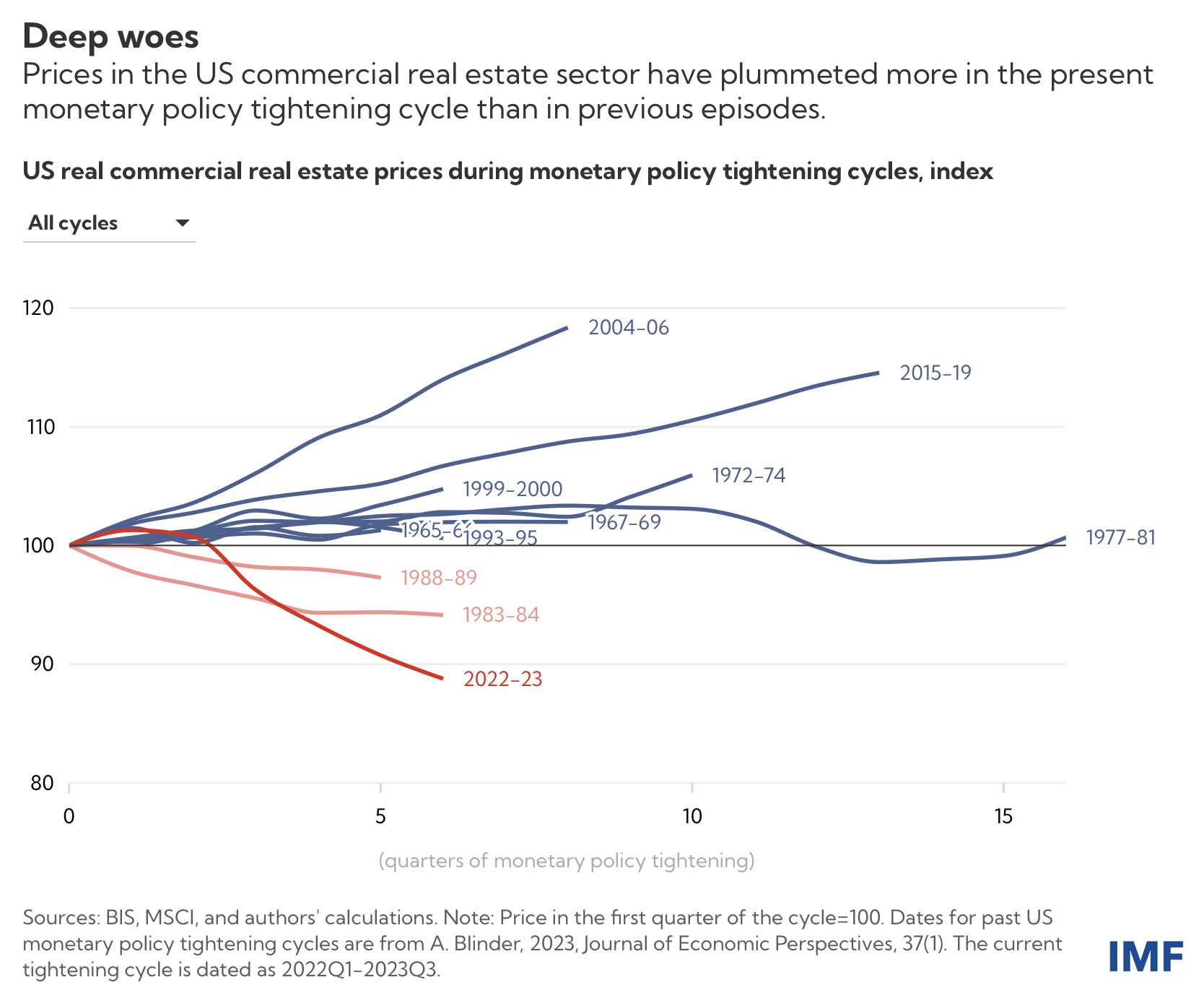

Commercial property prices in the US indicate that the market has been significantly impacted by relatively high interest rates. As shown in the visualization below, the current deal drought has led to the sharpest decline in property prices during a period of monetary policy tightening. This variance is attributed to the rapid rise in rates, which slowed down private equity—now a key source of financing in the sector.

US Commercial Real Estate Remains a Risk Despite Investor Hopes for Soft Landing – IMF (January 18, 2024)

In conclusion, managing interest rates is a delicate balancing act. Central banks must weigh the need for economic growth against the risks of inflation, while considering the broader impacts on labor markets, housing and investment. Small adjustments can have far-reaching consequences, making careful strategy essential to maintaining economic stability.

Help us make this series even better! We would love to hear your thoughts and suggestions on content makers we should follow to discover noteworthy projects and visualizations. Write to Bilal Siddika on LinkedIn or via email.