What better way to understand concepts big and small than through data visualizations? In this blog series, we curate insightful visuals to provide commentary on events, academic theories and themes related to economics and transportation. Join us as we explore and engage with interesting ideas from around the world.

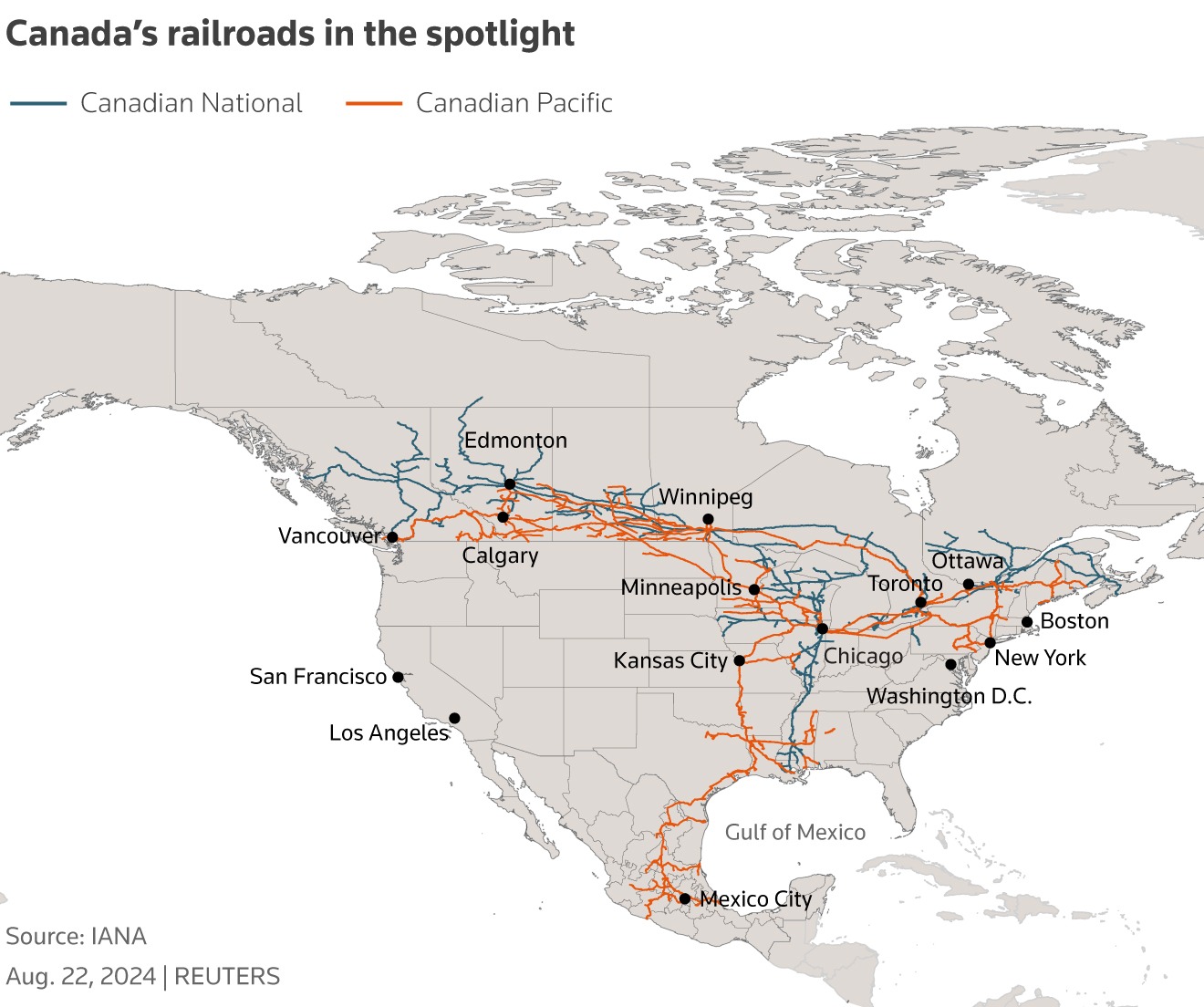

The ongoing labour disputes with Canadian National Railway (CN) and Canadian Pacific Kansas City’s (CPKC) workers brought both domestic and global supply chains fleetingly close to immense disruption. This week’s Data Vizdom highlights the far-flung effects these disruptions can have on the global economy, with rerouted traffic potentially altering supply chains permanently.

Canada rail shutdown: Union challenges government move – Reuters (August 24, 2024)

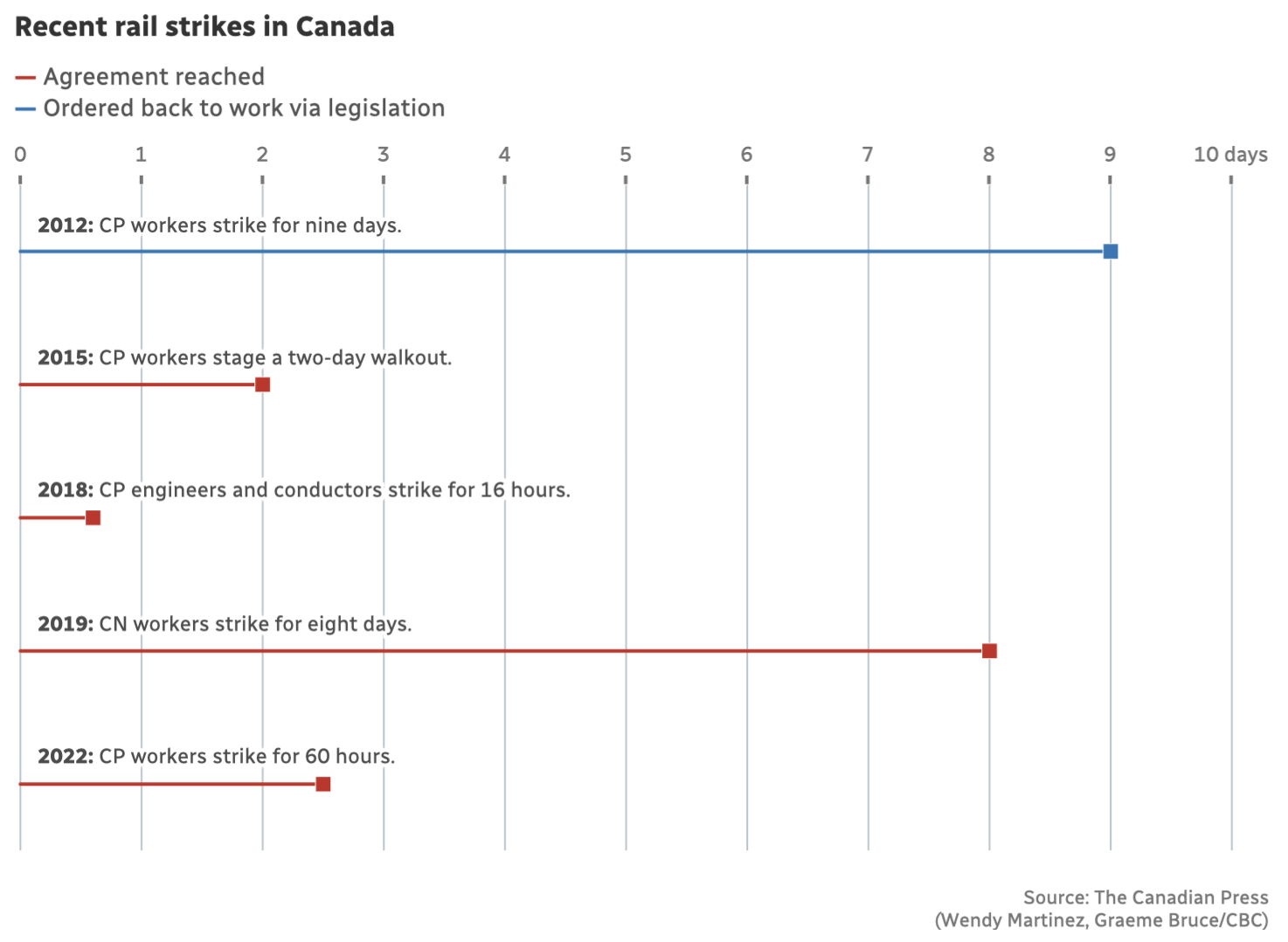

While the most recent rail strike is notable for simultaneously affecting both major rail companies for the first time, there have been previous strikes in recent years where services were disrupted for up to 9 days. The visualization below illustrates these past rail disruptions in Canada.

How a rail stoppage could affect freight, farming, french fries and more – CBC (August 21, 2024)

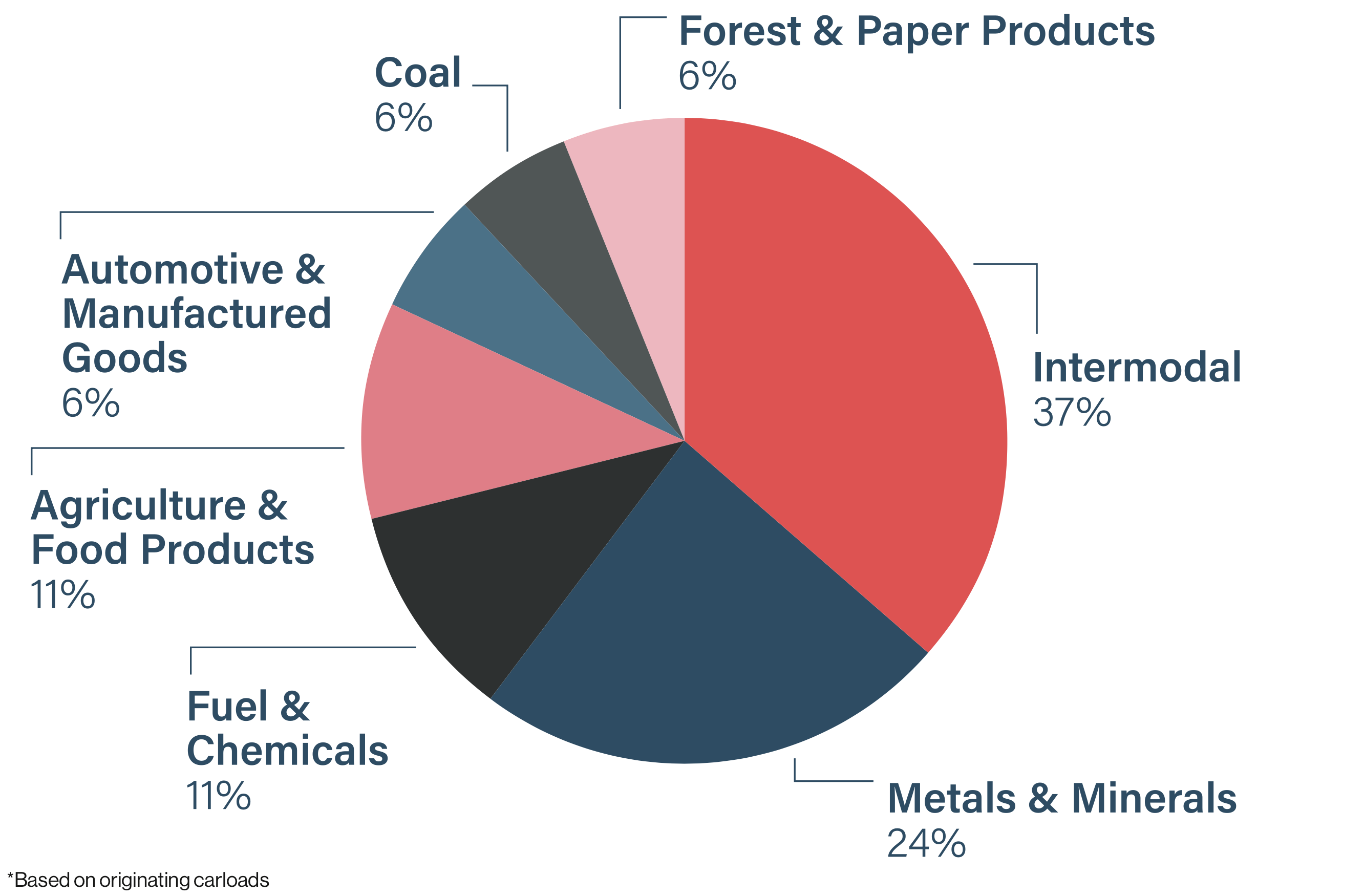

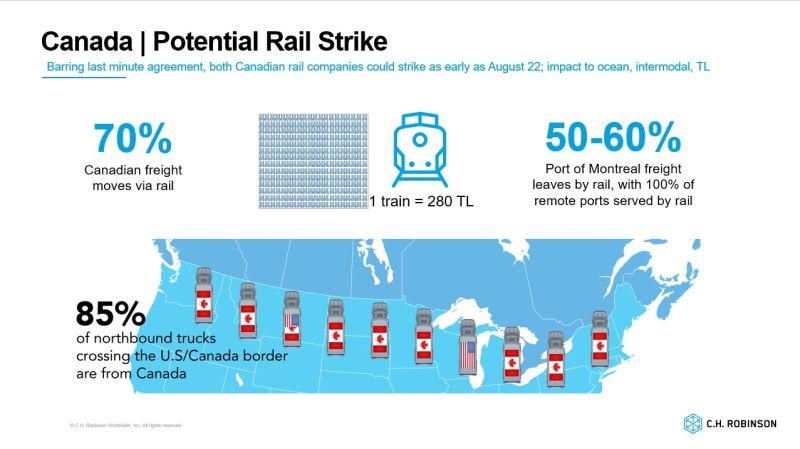

The country’s rail network is deeply integrated into supply chains, handling over 70 percent of all Canadian intercity surface freight and half of Canada’s exports worth $200 billion. This modal dependency affects all sectors of the economy, though some regions and industries are more significantly impacted. The following pie chart illustrates the different commodities that make up the 330 million tonnes of goods that flow through the country’s rail network.

Delivering Canada’s Amazing Products to the World – Railway Association of Canada (August 21, 2024)

Intermodal traffic, which involves the transportation of shipping containers and truck trailers by rail, is crucial for Canadian exports. Strategically located intermodal terminals facilitate the smooth transfer of freight between rail, ships, and trucks. As shown in the visualization below, over half of the freight from the Port of Montreal is transported by train, and all traffic at remote ports is served by rail.

Potential Rail Strike – Ryan Hammett (August 19, 2024)

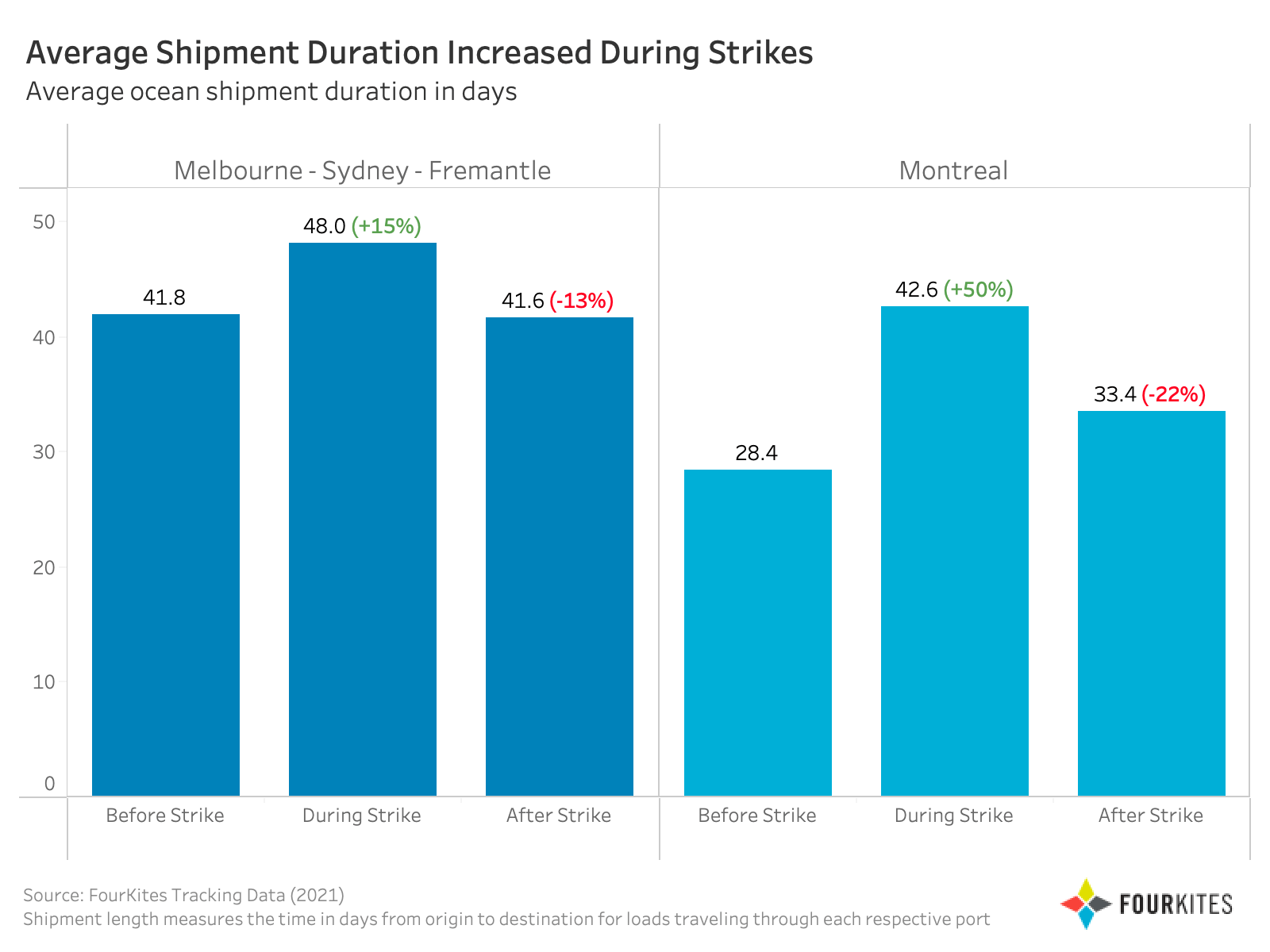

This interdependency between different modes of transportation means that a disruption in one affects the others. For example, a major freight forwarder diverted cargo from Canadian ports to alternatives in the US, using trucks to avoid relying on Canadian rail. While some economists expect traffic to recover after transportation disruptions, metrics tracking the average duration of ocean shipments show that delays persisted for shipments passing through the Port of Montreal even six weeks after the strikes.

The Threat of Labor Disruptions and How to Improve Supply Chain Resilience – FourKites (May 27, 2022)

To better understand the economic impact of such disruptions, Transport Canada, in collaboration with ESDC, estimated the potential impact on Canada’s GDP from a complete shutdown of the container and bulk terminals at the Port of Montreal due to a work stoppage. Their findings showed that losses would range from $3 to $6 million per day during the first 3-5 days, quickly rising to $15 million per day thereafter. They also identify potential rerouting options for each commodity type.

Spillover Simulator – IMF PortWatch (2024)

To conclude, the recent rail strikes reveal the vulnerability of supply chains to transport disruptions, sending ripples across industries and regions. Understanding the dynamics between trade and transport is crucial for strengthening supply chain resilience. Studies like those by Transport Canada are essential for revealing the economic impact of these disruptions, and with the SLGL DataHub, we aim to provide data-driven insights to support informed decision-making.

Help us make this series even better! We would love to hear your thoughts and suggestions on content makers we should follow to discover noteworthy projects and visualizations. Write to Bilal Siddika on LinkedIn or via email.