What better way to understand concepts big and small than through data visualizations? In this blog series, we curate insightful visuals to provide commentary on events, academic theories and themes related to economics and transportation. Join us as we explore and engage with interesting ideas from around the world.

The global economic landscape is greatly shaped by the cross-border flow of capital, which fosters regional development and enhances competitiveness. This week’s Data Vizdom explores the evolution and trends of Foreign Direct Investment (FDI) within the current geopolitical climate.

FDI refers to an investment made by an investor, company or government that results in at least a 10% ownership interest in a foreign company. These investments have flourished over the past decades due to the easing of regulations and trade barriers, allowing large multinational companies to move people and technology across borders. When expressed as a percentage of GDP, FDI inflows are a good indicator of a country’s competitiveness as an investment destination.

Foreign direct investment, net inflows as share of GDP – Our World in Data (2024)

On the other hand, FDI outflow indicates where investors from a particular country choose to allocate their capital, with developed countries often experiencing net outflows as they pursue international investment opportunities.

Foreign direct investment, net outflows as share of GDP – Our World in Data (2024)

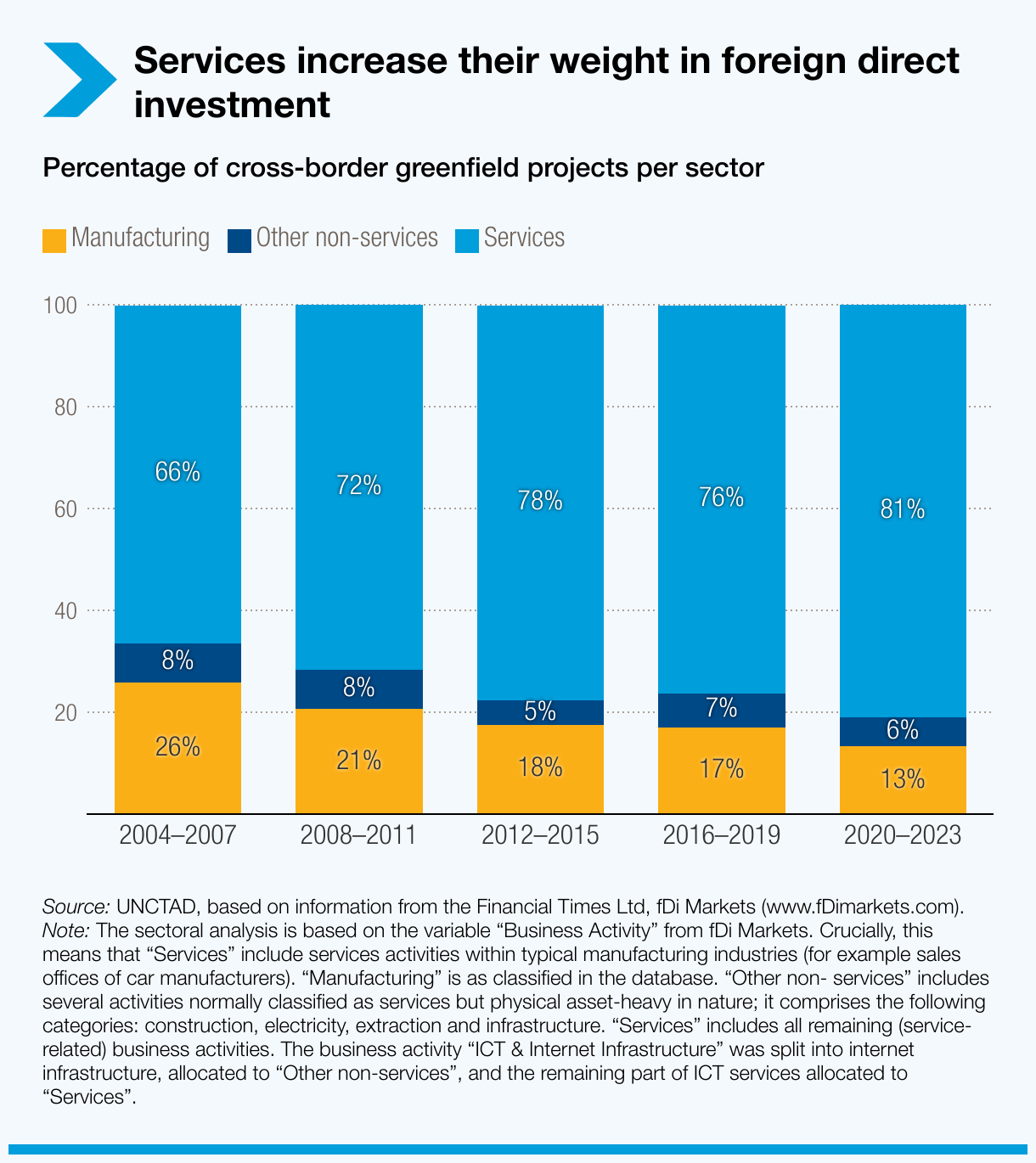

During the early 2000s, over a quarter of these investments were made in the manufacturing sector, with the majority directed toward the services sector. Over the years, investments in services have consistently outpaced those in manufacturing. While inflows and outflows are primarily driven by expected returns, sectoral trends may also be affected by restrictions on investments in strategic industries.

Shifting investment patterns: 5 key FDI trends and their impact on development – UNCTAD (April 23, 2024)

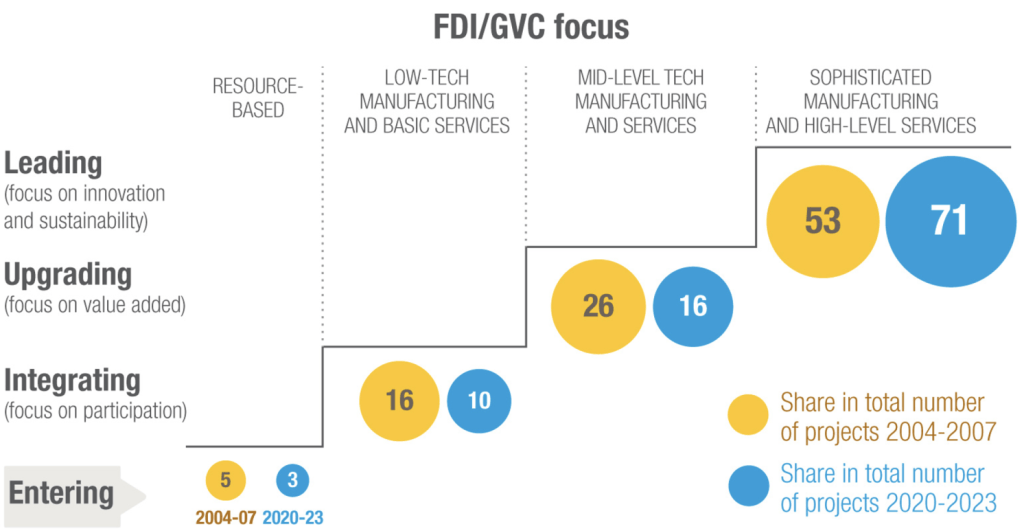

From a global value chain (GVC) perspective, the majority of these investments are directed toward the highest value-added activities, namely sophisticated manufacturing and high-level services. Interestingly, compared to the early 2000s, the proportion of investments in all other stages of GVCs has diminished over the past three years. This makes it harder for countries trying to climb the GVC ladder, as they compete for limited funds and opportunities.

Global economic fracturing and shifting investment patterns: A diagnostic of ten FDI trends and their development implications – CEPR (May 19, 2024)

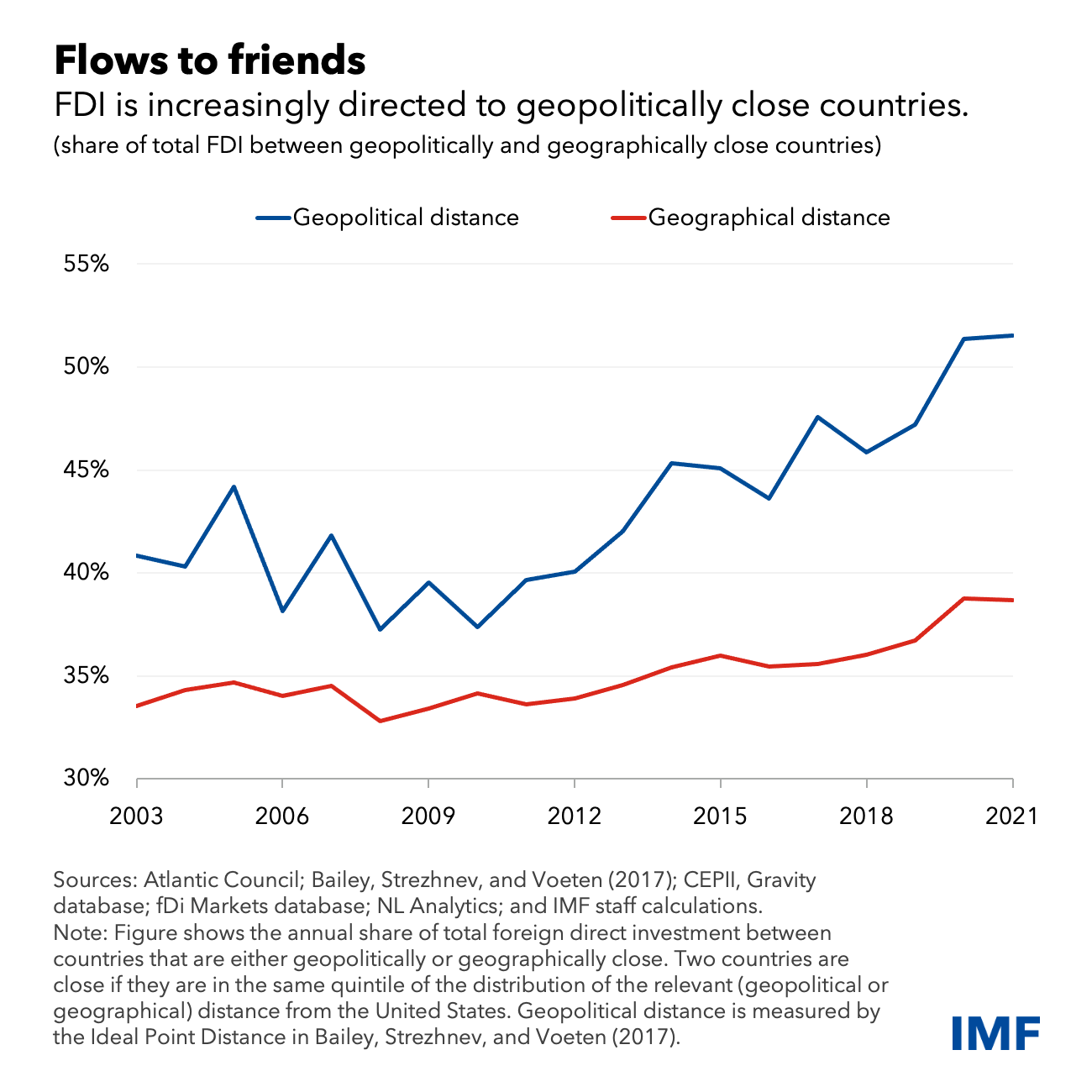

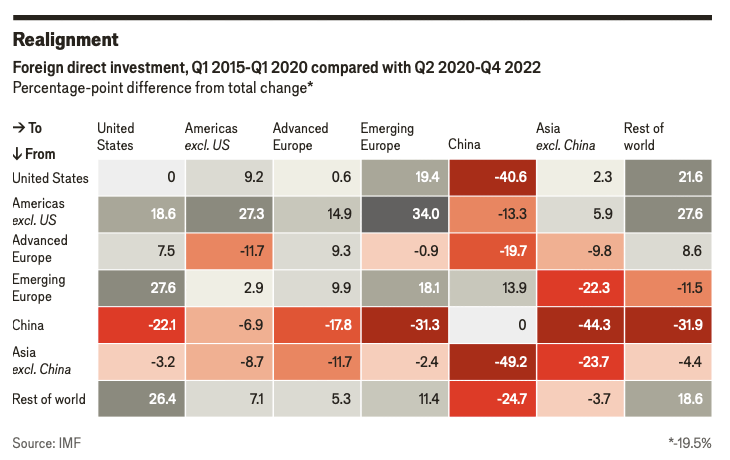

Trade tensions and the COVID-19 pandemic have led governments worldwide to recognize the risks of over-reliance on trade with a few countries, particularly for strategically significant goods like semiconductors. This realization has prompted a shift in globalization, with countries reintroducing industrial policies and implementing protectionist measures. As a result, FDI is increasingly being directed toward countries that are geopolitically aligned, even if they are geographically distant.

Fragmenting Foreign Direct Investment Hits Emerging Economies Hardest – IMFBlog (April 5, 2023)

The increased uncertainty since the pandemic has led to a global decrease in FDI of about 20%. However, these losses have been geographically uneven, with China experiencing the most significant decline compared to activity five years prior to the pandemic. The redirection of investment has brought opportunities for countries that are geopolitically aligned with the West.

The movement of capital globally is in decline – The Economist (May 3, 2024)

As geopolitical tensions continue to simmer, FDI is likely to continue concentrating within political blocs, potentially reshaping the structure of global value chains in the coming years. Smaller countries that heavily rely on FDI will be particularly affected by their political choices and may also miss out on opportunities to participate in higher value-added activities within GVCs.

Help us make this series even better! We would love to hear your thoughts and suggestions on content makers we should follow to discover noteworthy projects and visualizations. Write to Bilal Siddika on LinkedIn or via email.